Estimating a person's financial standing offers insights into their professional and personal life. A person's overall financial standing provides context.

A person's net worth represents the total value of their assets, minus any liabilities. Assets encompass various holdings, including investments, real estate, and personal possessions. Liabilities are debts or obligations. Determining this figure requires a comprehensive evaluation of these elements. For example, a person with significant investments, a valuable home, and minimal debts will likely have a higher net worth than someone with substantial debts and fewer assets.

Understanding a person's financial standing is significant for various reasons, including a better understanding of their financial capacity, the potential influence on their professional ventures, and the potential impact on societal perceptions. A person's financial standing is sometimes viewed as an indicator of their success, though this correlation is not universally applicable or accurate. This aspect can also be relevant in specific contexts, like business dealings or philanthropy.

| Category | Details (Placeholder) |

|---|---|

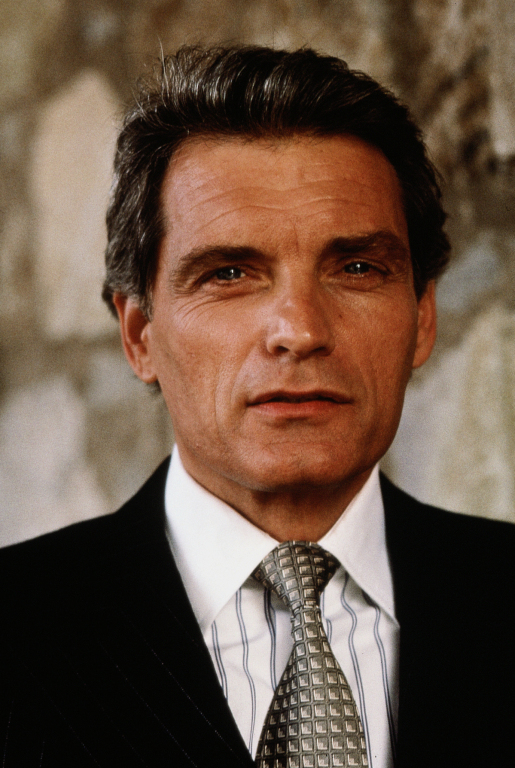

| Full Name | David Selby |

| Profession | (Placeholder - e.g., Actor, Entrepreneur) |

| Date of Birth | (Placeholder) |

| Location | (Placeholder) |

| Known for | (Placeholder - relevant details of David Selby) |

The following information is speculative and requires further investigation to confirm the figures mentioned in the article. A proper financial assessment typically relies on publicly available data, official statements, or other credible sources.

David Selby Net Worth

Assessing David Selby's net worth involves examining various financial factors to understand his overall financial standing.

- Assets

- Investments

- Income

- Liabilities

- Valuation

- Public Data

- Estimation

Analyzing David Selby's net worth necessitates scrutinizing his assets, such as real estate or investments. Income sources and liabilities also factor into the estimation. Publicly available data, if any, provides a starting point for valuation. Estimating net worth requires careful consideration of various factors, including potential unreported assets or undisclosed liabilities. A comprehensive analysis must include all of these elements to arrive at a reasonable estimation, recognizing that precise figures are often unavailable or uncertain.

1. Assets

Assets are crucial components in determining net worth. Their value, type, and ownership significantly impact the overall financial standing of an individual. Understanding the nature of assets held by David Selby is essential in assessing his financial position.

- Real Estate Holdings

Real estate holdings, such as homes or land, often represent a substantial portion of an individual's assets. The value of these holdings is influenced by location, size, condition, and market trends. Appraisals and market valuations are key elements in determining the worth of these assets.

- Investment Portfolio

Investments, including stocks, bonds, mutual funds, or other securities, are another important asset category. The value of investments fluctuates according to market conditions and performance. Historical records and current valuations are relevant in assessing the overall investment portfolio's worth.

- Personal Possessions

Personal possessions, such as valuable art, collectibles, or vehicles, may contribute to net worth. Determining the fair market value of these items necessitates expert appraisal. The inclusion and weighting of these assets in calculating net worth depend on their significance and value.

- Liquid Assets

Liquid assets, such as cash, bank accounts, and readily convertible investments, represent readily available funds. The availability and amount of liquid assets are critical in assessing an individual's financial flexibility and ability to meet financial obligations.

Collectively, these asset categories contribute to the overall estimation of David Selby's net worth. However, accurately determining the precise figure necessitates comprehensive information on the nature and value of each asset. Without detailed specifics, a precise evaluation is often impossible.

2. Investments

Investments play a significant role in determining an individual's net worth. The types, value, and performance of investments directly influence the overall financial standing. A substantial investment portfolio can contribute substantially to a high net worth, while underperforming investments might negatively impact the overall financial picture.

- Portfolio Composition

The types of investments held are critical. A diversified portfolio encompassing various asset classes, such as stocks, bonds, real estate, or alternative investments, generally offers more stability and potential returns than an investment concentrated in a single asset. The specific holdings in David Selby's investment portfolio (if known) would reveal details about investment strategy, risk tolerance, and potential for future growth.

- Investment Performance

Historical performance of investments is crucial. Consistent growth over time indicates successful investment strategies, whereas significant losses can diminish overall net worth. Analyzing performance trends and market conditions during specific periods relevant to David Selby's investments provides valuable context.

- Valuation and Appreciation

Accurate valuation of investments is essential. Fluctuations in market values directly impact the reported net worth. Factors such as current market conditions, economic forecasts, and sector-specific trends all influence the overall value of an investment portfolio.

- Tax Implications

Investment returns are often subject to taxes. The tax implications of various investments need consideration. Understanding the tax implications of investment income and capital gains is critical in assessing the true net benefit and understanding its impact on overall net worth.

Understanding the intricacies of investments and their impact on a person's net worth reveals the importance of well-considered investment strategies and sound risk management practices. The significance of investment performance, asset valuation, and tax implications underlines the complex interplay between investments and net worth. Without access to detailed information regarding David Selby's investments, a more precise analysis is impossible.

3. Income

Income represents a fundamental component in assessing an individual's net worth. The level and consistency of income directly influence the accumulation of assets and the capacity to manage liabilities. Understanding income sources and patterns is crucial for a comprehensive understanding of financial standing.

- Sources of Income

Income streams vary significantly. Salaries from employment, investment returns, and entrepreneurial endeavors are common examples. The nature and stability of these sources impact the long-term financial security and potential for wealth accumulation. If a significant portion of income relies on fluctuating market conditions or unpredictable sources, it may pose a risk to long-term financial stability.

- Income Stability

The consistency and predictability of income streams are critical. Regular, reliable income allows for budgeting, debt repayment, and savings. Fluctuations or uncertainties in income can jeopardize financial planning and lead to increased financial risk. Factors influencing income stability include industry trends, market conditions, and the nature of employment contracts.

- Income Growth Potential

The potential for income growth influences long-term financial prospects. Jobs or ventures with substantial room for advancement often translate to increased earning capacity over time. Individuals with roles offering limited growth may face challenges in accumulating wealth over extended periods. Analyzing industry trends and career progression paths provides insight into the potential for income growth.

- Tax Implications

Tax obligations significantly impact disposable income. The tax burden associated with different income sources needs consideration. Tax implications vary across jurisdictions and by income level, potentially reducing the effective net income. Understanding the tax implications associated with income sources is essential for accurate financial planning.

In summary, income, its sources, stability, growth potential, and tax implications, collectively influence the accumulation of wealth and the eventual net worth. Assessing these facets provides a clearer picture of an individual's financial capacity and trajectory. Without complete income data, an accurate estimate of an individual's net worth remains challenging.

4. Liabilities

Liabilities represent debts and obligations owed by an individual. They directly impact net worth by reducing the overall financial standing. The relationship is subtractive; liabilities are subtracted from assets to arrive at net worth. A significant amount of debt can considerably diminish net worth, potentially resulting in a negative net worth if liabilities exceed assets.

The importance of considering liabilities in assessing net worth cannot be overstated. Consider a scenario where an individual owns a valuable property but also carries substantial mortgage debt. While the property adds to assets, the mortgage debt is a liability. Calculating the net worth requires subtracting the mortgage amount from the property's value. Similarly, outstanding loans, credit card balances, and other financial obligations need to be accounted for. Without acknowledging these obligations, the true picture of financial health is incomplete.

Understanding the connection between liabilities and net worth is crucial for sound financial management. Individuals can evaluate their financial position more accurately by factoring in liabilities. This awareness allows for proactive steps to manage debt, potentially reducing liabilities and improving the overall net worth. Analyzing debt levels, interest rates, and repayment schedules provides a framework for financial strategies, including potential debt reduction plans. Ultimately, a thorough understanding of liabilities is essential for responsible financial decision-making and avoiding potentially adverse financial consequences.

5. Valuation

Valuation is a critical component in determining David Selby's net worth. It involves assessing the monetary worth of various assets. Accurate valuation is essential to create a comprehensive and reliable picture of net worth. Errors in valuation can lead to misrepresentation of financial standing. Assets like real estate, investments, and personal possessions require careful evaluation to be included correctly in the calculation.

The methods used for valuation vary depending on the asset type. Real estate often utilizes appraisal services, considering factors such as location, size, condition, and comparable sales in the market. Investment valuations rely on market prices, historical performance, and expert analysis of the securities' intrinsic value. Personal possessions, like artwork or collectibles, might involve professional appraisals to determine fair market value. The accuracy and thoroughness of these valuation processes directly affect the precision of the calculated net worth. For instance, if a piece of real estate is undervalued, the overall net worth will be understated. Conversely, overvaluation of assets can inflate the net worth incorrectly.

Understanding the role of valuation in determining net worth is vital for several reasons. It provides a clear and concise snapshot of financial standing. Accurate valuations ensure a transparent assessment, reducing the risk of misrepresentation or miscalculation. This understanding is especially pertinent in financial planning, estate planning, or business transactions. It allows for informed decisions, providing a benchmark for financial strategy, investment planning, and potentially even negotiations. Ultimately, accurate valuation ensures the reliability of the net worth figure, providing a foundation for sound financial decision-making.

6. Public Data

Publicly accessible data plays a crucial role in estimating net worth, yet its direct correlation with precise figures is often indirect and incomplete. Public records, financial disclosures, and news reports can offer clues to a person's financial standing. For instance, property records may reveal real estate holdings, and public filings for companies might indicate investment activity. However, these sources often lack the comprehensive detail necessary for a definitive calculation. Furthermore, reported information may not reflect the entirety of an individual's assets or liabilities, as some holdings might remain private. News articles or social media posts can hint at financial situations but do not constitute definitive proof of net worth.

The practical significance of understanding this connection is threefold. First, it highlights the limitations of publicly available data in achieving precise net worth estimations. Second, it underscores the importance of differentiating between public hints and verifiable, documented figures. Third, it encourages critical evaluation of reported information, avoiding potential misinterpretations or overly simplistic conclusions. For example, a celebrity's lavish lifestyle might lead to speculation about a high net worth, but without supporting documentation, this speculation remains unsubstantiated. Similarly, news reports about investments or successful ventures do not provide evidence of the actual financial impact or the overall total net worth.

In summary, public data, while offering insights into a person's potential financial standing, often falls short of providing a complete picture of their net worth. This limitation necessitates careful analysis and the recognition that estimations based solely on publicly accessible data can be incomplete and potentially misleading. The absence of comprehensive, verifiable data often prevents the creation of fully reliable net worth estimations, even in cases where the individual is a prominent public figure. Researchers and individuals seeking precise net worth figures must supplement public data with other credible sources for more reliable results.

7. Estimation

Estimating David Selby's net worth necessitates a careful consideration of available data, acknowledging the inherent limitations and potential for inaccuracies. This process involves piecing together various elements to arrive at an approximation, recognizing that a precise figure is often unattainable. The estimation process itself is crucial for understanding the potential financial standing of an individual, allowing for informed discussions and considerations, though exact accuracy is not guaranteed.

- Data Sources and Limitations

Estimating net worth requires evaluating accessible data sources. Public records (property deeds, tax filings, corporate filings) and news reports can offer initial clues. However, these sources frequently lack the comprehensive detail required for a precise calculation. Moreover, certain assets and liabilities might remain undisclosed, adding uncertainty to the estimation process. For instance, significant private investment holdings or hidden debts remain unaccounted for, rendering a complete estimation impossible.

- Valuation Methods and Assumptions

Valuation methods play a significant role in the estimation process. Real estate valuations often employ comparative market analysis. Investment valuations depend on market trends, asset types, and expert assessments. However, these methods come with inherent assumptions. Market fluctuations, changing economic conditions, or evolving legal frameworks can affect the accuracy of estimations. For example, rapid market changes can render prior valuations obsolete, necessitating adjustments to the estimation process.

- Potential Biases and Errors

Subjectivity and potential biases can impact the estimation process. The selection of data sources, the interpretation of valuation methods, and the assessment of market trends can introduce errors. For instance, a reliance on outdated or incomplete data could lead to an inaccurate estimation. Furthermore, the presence of conflicting data or conflicting valuations can lead to disparities among estimations.

- Contextual Factors and Uncertainty

External factors like economic conditions, industry trends, and legal environments influence valuation and estimations of net worth. Market fluctuations, for example, significantly affect investment values. These variables often introduce uncertainty, impacting estimations' reliability. Estimating net worth, therefore, is inherently a process of approximation, not absolute certainty. Understanding the contextual factors at play is crucial for interpreting the validity and precision of estimations.

In conclusion, estimating David Selby's net worth is a complex process, requiring careful evaluation of various factors. The inherent limitations of available data, the application of valuation methods, and the influence of external factors contribute to the degree of uncertainty in the estimation. Recognizing these limitations is crucial for understanding the nature of estimations and interpreting them within their appropriate context.

Frequently Asked Questions About David Selby's Net Worth

This section addresses common inquiries regarding David Selby's net worth, providing clear and concise answers based on available information. While precise figures are often unavailable, these responses offer insight into the factors influencing estimations.

Question 1: What is net worth?

Net worth represents the total value of an individual's assets, minus their liabilities. Assets encompass various holdings, including investments, real estate, and personal possessions. Liabilities are debts or financial obligations.

Question 2: How is net worth estimated?

Estimating net worth involves evaluating available data, including public records (property deeds, tax filings, corporate filings), news reports, and financial disclosures. Valuation methods and market analysis (for investments, real estate) are crucial, but a precise calculation is often elusive due to incomplete data or undisclosed assets/liabilities.

Question 3: Why are precise figures often unavailable for net worth?

Precise figures are often unavailable because much financial information remains private or undocumented. Investment holdings, complex financial instruments, and personal assets are often not part of public records. Furthermore, economic conditions, market fluctuations, and changing valuation methodologies can impact estimations.

Question 4: Can public information help estimate net worth?

Public information can offer clues, but it's insufficient for a definitive calculation. News reports, social media posts, or celebrity lifestyle details might hint at financial standing, but are not definitive evidence. Actual net worth calculations rely on more thorough and verifiable data.

Question 5: What are the limitations of net worth estimations?

Estimating net worth is inherently approximate. The accuracy of estimations depends on the availability and reliability of data. Economic conditions, changing market values, and undisclosed assets/liabilities all contribute to the uncertainty inherent in any estimation. Subjectivity in valuation methods and potential biases further contribute to these limitations.

Understanding the factors affecting estimation and the inherent limitations is crucial for interpreting reported figures responsibly.

The following section delves into the specific considerations for understanding the context surrounding David Selby's finances.

Conclusion Regarding David Selby's Net Worth

Determining David Selby's net worth presents significant challenges due to the inherent limitations of publicly available information. While various factors, including asset valuations, income sources, and liabilities, contribute to a comprehensive understanding of financial standing, a precise figure remains elusive. Public records often lack the detailed specifics required for definitive calculation. The complexity of financial instruments, private investment holdings, and undisclosed debts further complicate the estimation process. Consequently, any figures presented as David Selby's net worth should be approached with appropriate skepticism, recognizing them as estimations, not definitive statements.

The exploration of David Selby's financial standing highlights the fundamental difference between public perception and demonstrable fact. Public discussions about wealth frequently rely on incomplete information, potentially leading to inaccuracies and misinterpretations. This underscores the importance of relying on verifiable sources and rigorous analytical methods when assessing financial situations. A nuanced approach, incorporating both public and private data when possible, is crucial to creating a more accurate and comprehensive understanding of an individual's financial profile. Future investigations should emphasize the limitations of publicly available information and focus on verifiable documentation whenever possible.