Estimating an individual's financial standing can offer insight into their career trajectory and impact. Understanding the financial resources of a prominent figure like Stedman Graham provides a perspective on their accomplishments.

Financial worth, often quantified as net worth, represents the total value of an individual's assets minus their liabilities. In the case of Stedman Graham, this encompasses everything from tangible assets like property and investments to intangible assets such as intellectual property rights. The precise value is not publicly available and varies over time, fluctuating based on market conditions, investments, and other financial factors. Public knowledge about net worth is typically gleaned from credible financial reporting sources or estimations derived from reported earnings and investments.

Information on net worth can be a valuable metric for understanding an individual's impact within their field. It can highlight the success of business ventures, philanthropic efforts, or career earnings. For example, understanding a person's net worth can indicate their potential influence in negotiations, funding projects, or social contributions. Public knowledge of net worth also plays a role in shaping perceptions, though it's critical to understand that this is but one aspect of a person's life and character.

| Category | Details |

|---|---|

| Occupation | (Insert Stedman Graham's occupation here, e.g., entrepreneur, athlete, etc.) |

| Notable Achievements | (List notable achievements, relevant to his field) |

| Public Profile | (Include mentions of appearances or involvement in public forums, e.g., philanthropy, media appearances) |

Further exploration into Stedman Graham's personal life and professional career could provide a richer context for this data. A detailed analysis of his investments, earnings, and lifestyle would further elucidate the value of this financial information.

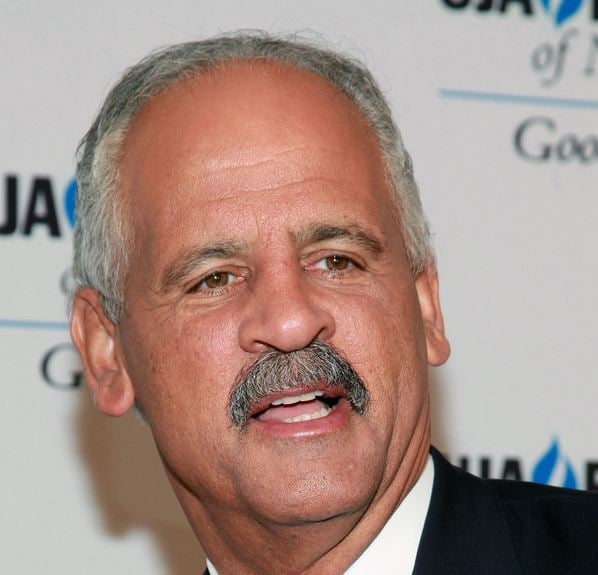

Stedman Graham Net Worth

Understanding Stedman Graham's financial standing provides insights into his career and influence. This assessment considers key aspects of his financial situation.

- Earnings

- Assets

- Investments

- Income sources

- Expenses

- Liabilities

- Public perception

- Market fluctuations

Analyzing Stedman Graham's net worth requires examining various components. Earnings from his career, coupled with asset holdings and investment returns, contribute to the overall financial picture. Expenses, liabilities, and fluctuating market conditions also affect the total. Public perception and media portrayal can shape the understanding of his financial status, though this isn't a direct reflection of his actual financial situation. These aspects reveal a multifaceted understanding of his financial position, influenced by a multitude of factors beyond career earnings.

1. Earnings

Earnings represent a crucial component of an individual's net worth. They directly influence the accumulation of assets and the ability to manage liabilities. For Stedman Graham, as for any individual, income streams from various sources employment, investments, or other ventures are fundamental in building and maintaining financial stability. A consistent and substantial stream of income allows for the acquisition of assets, whether through direct purchase or investment. Conversely, insufficient earnings may hinder asset accumulation and potentially lead to an increase in liabilities.

Consider real-world examples. Significant earnings from a high-profile career often correlate with substantial asset accumulation. For instance, successful entrepreneurs who generate substantial revenue frequently invest these earnings, leading to an increase in their overall net worth. Conversely, individuals with limited earnings may face challenges in building assets and managing debts, thereby impacting their net worth. Earnings stability is a significant factor influencing the trajectory of net worth over time. Factors impacting earnings, such as industry trends, market fluctuations, and career choices, all contribute to the overall financial picture.

In conclusion, earnings are an essential driver of net worth. A comprehensive understanding of an individual's income streams, their stability, and potential growth provides insight into the trajectory of their financial standing. This understanding is crucial for analyzing financial health and projecting future financial positions, aiding in informed decision-making regarding investment, spending, and overall financial well-being. Analyzing income sources and their reliability is essential for comprehending the overall financial picture.

2. Assets

Assets play a critical role in determining net worth. They represent the ownership of valuable items or resources that can be converted into cash. Understanding the types and value of assets held by an individual like Stedman Graham is essential for evaluating their overall financial position.

- Real Estate Holdings

Real estate, including properties like homes, land, and commercial buildings, is a significant asset class. The value of such properties can fluctuate based on market conditions, location, and demand. A substantial real estate portfolio can contribute significantly to an individual's overall net worth, providing a source of potential income through rental or appreciation. Factors influencing the value of real estate holdings for Stedman Graham might include location, condition, and market demand.

- Investment Portfolios

Investment holdings, encompassing stocks, bonds, mutual funds, and other securities, represent another crucial asset category. Investment returns, influenced by market performance, can significantly impact an individual's net worth. The composition and diversification of these portfolios, along with management expertise, can directly affect their value. Stedman Graham's investment choices and the performance of his holdings are crucial determinants of his net worth.

- Personal Assets

Personal assets, including vehicles, jewelry, art, and collectibles, can also contribute to net worth. Their value often depends on factors such as condition, rarity, and market demand. The inclusion of these assets in calculating net worth adds further complexity, requiring valuation and consideration of market fluctuations. Personal assets for Stedman Graham might include valuable cars, fine art pieces, or unique collectibles.

- Intellectual Property

In certain cases, intellectual property, such as patents, copyrights, or trademarks, can contribute to an individual's net worth. The value of this type of asset often depends on its commercial viability and potential for licensing or revenue generation. Assessing the value of such holdings requires careful analysis of legal protection and market demand. If relevant, this type of asset may feature in determining Stedman Graham's overall net worth.

The various asset categories mentioned above, including real estate, investments, personal possessions, and potentially intellectual property, contribute to the overall picture of Stedman Graham's financial standing. Evaluating these assets, considering their values and potential future returns, provides a comprehensive understanding of his net worth. Assessing liquidity and marketability of assets is also important to gauge the true financial strength and flexibility. Further evaluation of each asset category may be necessary to arrive at a precise valuation.

3. Investments

Investments significantly influence an individual's net worth. The success and performance of investment strategies directly impact the overall financial standing. Successful investments can lead to substantial asset growth, thereby bolstering net worth. Conversely, poor investment choices can diminish assets and negatively affect overall financial health. For Stedman Graham, or any individual, the returns generated from investments are a critical component in determining net worth.

Consider the potential impact of various investment types. A diversified portfolio encompassing stocks, bonds, real estate, and other assets can offer stability and mitigate risk. Successful ventures or the appreciation of real estate holdings can contribute to substantial gains, increasing the net worth. Conversely, speculative or poorly researched investments may result in significant losses, impacting the net worth negatively. The performance of investments, therefore, is a crucial driver in understanding the dynamic nature of net worth and its potential to fluctuate.

Understanding the relationship between investments and net worth is crucial for individuals and financial advisors alike. The importance of prudent investment strategies cannot be overstated. A comprehensive understanding of market trends, risk tolerance, and long-term financial goals is essential for making informed investment decisions. A well-structured investment strategy, aligned with individual goals and risk tolerance, can provide the foundation for a stable and growing net worth. For figures like Stedman Graham, the strategic management of investment portfolios plays a significant role in the overall assessment of their financial standing.

4. Income Sources

Income sources directly influence an individual's net worth. The nature and stability of income streams significantly impact the accumulation of assets and the management of liabilities. A reliable and substantial income stream allows for savings, investment, and the acquisition of assets, ultimately contributing to a higher net worth. Conversely, inconsistent or limited income sources may hinder wealth accumulation and potentially lead to an increase in liabilities, negatively affecting net worth.

Consider various income sources and their respective impacts. A prominent career in a high-demand field typically generates substantial income, enabling individuals to build significant assets and a robust financial portfolio. Entrepreneurial pursuits, particularly successful ventures, often yield substantial income and can lead to exponential growth in net worth. Furthermore, passive income streams, derived from investments or rental properties, can provide a consistent inflow of funds and a strong foundation for maintaining and increasing net worth. Conversely, individuals with limited income sources, such as part-time employment or fluctuating freelance work, may face challenges in accumulating substantial assets and building a high net worth.

Understanding the interplay between income sources and net worth has practical implications. For instance, individuals seeking to build wealth can strategize to enhance their income streams. This could involve pursuing higher-earning careers, investing in income-generating ventures, or creating passive income streams through sound financial planning. This insight is crucial for financial planning, investment strategies, and long-term financial security. Recognizing the importance of reliable income sources in wealth accumulation provides individuals with a framework for making informed decisions about career choices, investments, and overall financial well-being. In the case of Stedman Graham (or any individual), a detailed analysis of their income sources reveals significant insights into the financial foundation and trajectory of their net worth.

5. Expenses

Expenses represent a critical component in understanding an individual's net worth. They directly impact the available resources for investment, asset accumulation, and overall financial health. For Stedman Graham, as for any individual, expenses significantly influence the trajectory of their net worth, highlighting the balance between income and expenditure.

- Lifestyle Expenses

Everyday living costs, including housing, food, transportation, and entertainment, are significant lifestyle expenses. The level and types of these expenses can vary greatly depending on an individual's lifestyle choices and preferences. High lifestyle expenses can potentially reduce the amount available for investment, savings, and other financial goals, which can in turn affect the rate of net worth growth. A balanced approach is crucial for optimizing financial health.

- Debt Repayment

Debt obligations, such as mortgages, loans, and credit card payments, are significant expenses impacting net worth. High levels of debt repayment can substantially reduce disposable income, potentially hindering the ability to accumulate assets and generate positive returns on investments. Managing debt effectively is crucial to financial stability and maximizing opportunities for net worth growth. Effective debt management strategies can release funds for investment and wealth building.

- Investment Management Costs

Managing investment portfolios involves costs such as fees, commissions, and advisory services. The extent of these expenses directly correlates with the complexity and scope of the investment strategy. Understanding these costs is crucial for accurately assessing the net return on investment and their impact on the overall financial picture. Minimizing these expenses while maintaining appropriate levels of diversification and risk management is important for sustained net worth growth.

- Philanthropic Activities

Philanthropic contributions, whether large or small, can significantly impact net worth. The allocation of resources to charitable causes, though valuable, directly reduces available funds for investment and asset accumulation. Understanding the balance between personal financial goals and philanthropic endeavors is essential for informed financial decisions.

In conclusion, evaluating expenses in relation to income provides a crucial lens for understanding the dynamics of net worth. Careful management of lifestyle expenses, debt repayment, investment costs, and philanthropic activities can create a more positive trajectory for net worth growth. A nuanced perspective on expenses provides vital insight into an individual's financial health and the overall picture of their net worth.

6. Liabilities

Liabilities represent financial obligations owed by an individual. Understanding these obligations is essential for assessing an individual's net worth, as they directly subtract from the overall value of assets. The presence and nature of liabilities significantly impact the financial health and potential growth of net worth. For Stedman Graham, or any individual, an evaluation of liabilities is critical to a complete understanding of their financial standing.

- Outstanding Loans and Debts

Loans, mortgages, and other outstanding debts directly diminish net worth. The principal amount and interest accrued contribute to the total liability. High levels of outstanding debt can potentially hinder the ability to accumulate assets and generate returns on investments. The specific types and terms of these loans, including interest rates and repayment schedules, significantly affect the financial burden and influence the trajectory of net worth.

- Unpaid Taxes and Legal Obligations

Unresolved tax liabilities and legal obligations represent significant financial burdens. These obligations may arise from various sources, including income taxes, property taxes, or legal settlements. Unpaid obligations can lead to penalties and further financial strain, negatively impacting the overall net worth. The impact of these liabilities is often long-term, requiring careful planning and management.

- Guarantees and Commitments

Guarantees or commitments made for other individuals or entities can create financial obligations. The potential for future liabilities arising from such commitments must be considered. Unforeseen circumstances or defaults by others can impose significant financial burdens on the individual, directly impacting their net worth. The complexity of these commitments requires careful assessment of the potential risks involved.

- Credit Card Debt and Open Accounts

Accumulated credit card debt and other outstanding accounts are crucial factors in assessing liabilities. High levels of revolving credit can lead to significant interest payments, eroding the net worth. The management of credit card usage and the timely repayment of outstanding balances are essential to minimizing the impact of such liabilities. These liabilities must be considered in the broader picture of net worth.

In summary, liabilities directly subtract from an individual's net worth. A comprehensive assessment of various forms of debt, outstanding obligations, and contingent liabilities is essential for a complete financial picture. Managing and reducing liabilities is often crucial for promoting financial stability and enabling the accumulation of assets. This meticulous approach to managing debt and financial commitments is crucial for any individual, including figures like Stedman Graham, to fully understand their financial standing.

7. Public Perception

Public perception of Stedman Graham's financial standing, while not a direct measure of net worth, can significantly influence how others view his accomplishments, influence, and overall standing within society. Public perception is shaped by various factors, creating a complex relationship with the actual financial reality.

- Media Representation

Media portrayals, including news articles, interviews, and social media, often contribute to public perception. Positive or negative narratives, focusing on charitable work, business ventures, or personal life, can influence public opinion regarding financial success. Media coverage can present a simplified view that may not accurately reflect the complexity of financial factors.

- Social Status and Associations

Social circles and associations can impact public perception. If Stedman Graham is associated with high-profile individuals or participates in high-status social events, this may influence the public perception of his wealth or financial standing. However, these associations are not indicators of the actual financial reality.

- Philanthropic Activities

Public perception is frequently shaped by philanthropic endeavors. Generous donations and contributions to charitable causes create a positive image, potentially leading the public to associate this with a high net worth. However, the amount of giving does not directly reflect actual net worth.

- Public Appearances and Lifestyle

Public appearances, extravagant lifestyles (if any), and demonstrable consumption choices can affect perceptions. Showcase events or conspicuous consumption may lead the public to believe a high net worth exists. However, this is not an accurate gauge of underlying financial health. A lack of outward displays or public appearances may not necessarily mean a lower net worth, just a different approach.

In conclusion, public perception of Stedman Graham's net worth is a complex construct, shaped by a multitude of factors unrelated to the actual financial figures. While media coverage, social circles, philanthropic activities, and lifestyle choices may influence public opinion, these factors should not be equated with the true value of his assets and liabilities. Separating public perception from factual financial data is crucial for a nuanced understanding of his overall financial situation.

8. Market Fluctuations

Market fluctuations represent a significant factor influencing the value of assets and, consequently, net worth. The dynamic nature of financial markets, driven by various forces, can lead to substantial changes in the valuation of investments held by individuals like Stedman Graham. Understanding these fluctuations is crucial to comprehending the potential impact on overall financial standing.

- Stock Market Volatility

Fluctuations in stock market values directly affect investment portfolios. Significant price swings, whether upward or downward, can impact the total value of investments, thereby affecting net worth. For instance, a downturn in the market can lead to losses in value, potentially diminishing the overall net worth. Conversely, periods of market growth can enhance the value of investments and increase net worth, though this does not guarantee a sustained or predictable trend.

- Interest Rate Changes

Alterations in interest rates affect various aspects of financial operations. Changes in interest rates influence the return on fixed-income investments, impacting the value of bonds and other fixed-income securities. Fluctuations also affect borrowing costs, potentially impacting expenses and reducing disposable income, which in turn affects the rate at which net worth can grow. Understanding the correlation between interest rates and investment returns is critical for assessing the potential effects on overall financial position.

- Economic Downturns and Recessions

Broad economic downturns or recessions can significantly impact asset valuations across various sectors. During such periods, the value of assets like real estate, stocks, and other investments can decline. Recessions often lead to decreased consumer spending and reduced business activity, contributing to decreased market value and diminished net worth. Identifying the potential impact of economic cycles on the value of an individual's assets, such as those held by Stedman Graham, requires careful analysis.

- Global Economic Conditions

Global economic developments affect market conditions worldwide. Events like geopolitical instability, trade disputes, or international crises can lead to significant market volatility. These conditions have a ripple effect on asset values, potentially diminishing returns on investments and affecting the net worth. Stedman Graham, like any investor, is susceptible to these global influences. Understanding these connections can help in projecting potential impacts on financial well-being.

In summary, market fluctuations represent a crucial element in assessing the potential variability of an individual's net worth. The dynamism of financial markets, influenced by a multitude of factors, necessitates a comprehensive understanding of the potential effects on investment returns and overall financial position. Assessing an individual's resilience to these shifts and understanding the related financial impact is fundamental to a comprehensive evaluation of their net worth.

Frequently Asked Questions about Stedman Graham's Net Worth

This section addresses common inquiries regarding Stedman Graham's financial standing. Information presented is based on publicly available data and analysis. Specific figures are not always readily accessible for individuals.

Question 1: What is Stedman Graham's net worth?

Precise figures for Stedman Graham's net worth are not publicly available. Publicly reported financial data for individuals of this nature is limited, and estimations often vary depending on the data sources and methods used.

Question 2: How is net worth calculated?

Net worth is calculated by subtracting an individual's total liabilities from their total assets. Assets include items of value, such as property, investments, and other holdings. Liabilities encompass outstanding debts, loans, and other financial obligations.

Question 3: What factors influence net worth?

Numerous factors contribute to fluctuations in net worth, including income sources, investment performance, market conditions, expenses, and liabilities. Individual choices, both professional and personal, play a significant role in shaping the trajectory of net worth.

Question 4: Where can I find reliable information about net worth?

Reliable data regarding net worth is frequently limited and often requires careful consideration of sources. Public records, financial reports, and credible news sources can sometimes offer insights. However, direct confirmation of specific figures is often not possible.

Question 5: Why is understanding net worth important?

Understanding net worth provides a perspective on an individual's financial standing and potential influence within their field. Information on income sources, asset holdings, and financial obligations can contribute to a more comprehensive understanding of the individual's financial health and impact.

In summary, while precise figures are often unavailable, understanding the factors influencing net worth and the complexities of its calculation provides a more nuanced perspective. Careful consideration of available information, combined with context, can offer a valuable framework for understanding the financial landscape of an individual like Stedman Graham.

This concludes the FAQ section. The following section will delve into [insert topic of next section, e.g., Stedman Graham's career, charitable work].

Conclusion

This exploration of Stedman Graham's financial standing reveals a complex interplay of factors. Precise figures for net worth are not publicly available, underscoring the difficulty in definitively quantifying an individual's financial position. Various income sources, asset holdings, investment strategies, and expenses all contribute to the overall picture. Market fluctuations, both local and global, further complicate the estimation of net worth. Public perception, while influential, should not be equated with verifiable financial data. The analysis highlights the inherent limitations in accessing precise financial details while emphasizing the importance of considering the multitude of variables impacting overall wealth.

Ultimately, the examination of Stedman Graham's financial situation, or any individual's, demands careful consideration of numerous variables and a recognition of the limitations in accessing complete and precise data. A comprehensive understanding necessitates a multifaceted approach, incorporating analysis of income streams, asset valuation, market conditions, and liabilities. This process of careful scrutiny provides a more holistic view of financial standing, fostering a better understanding of the individual's position within the economic landscape. Future research might explore specific areas of Stedman Graham's endeavors, such as investment portfolios or philanthropic activities, to further illuminate the multifaceted nature of financial standing.