What is the financial standing of this individual? Understanding an individual's financial position can provide insight into career success and life choices.

An individual's net worth represents the total value of assets owned, minus any liabilities owed. For Patrick Labyorteaux, this would encompass everything from real estate holdings and investment portfolios to personal assets, such as vehicles, and subtract outstanding debts, such as mortgages or loans. Publicly available information on this figure is often limited, relying on estimations derived from various sources or reported financial data.

Public knowledge of an individual's financial standing, though often incomplete, can be of interest to a variety of audiences. It might be relevant for those researching career paths or those seeking to evaluate the financial outcomes of specific career choices. Historical context regarding economic conditions or industry trends may further inform the interpretation of this data. The individual's earnings and investment strategies could be analyzed. Determining the source of wealth and lifestyle choices can be a subject of discussion for those seeking to better understand individual life experiences and economic factors.

| Category | Details |

|---|---|

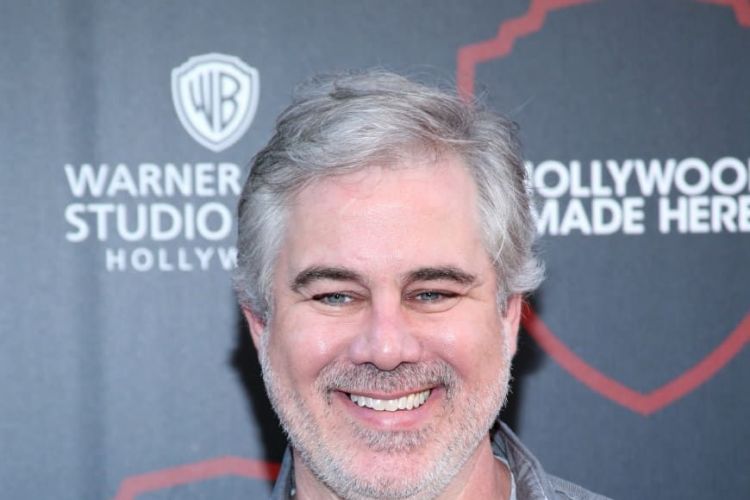

| Name | Patrick Labyorteaux |

| Profession | Actor |

| Notable Roles | (List key roles here, e.g., "The Young Indiana Jones Chronicles", etc.) |

Further research into specific aspects of Mr. Labyorteaux's career and life would be needed to provide a complete picture and understand any specific motivations or choices driving his financial situation. This article does not attempt to offer a comprehensive financial analysis of Mr. Labyorteaux.

Patrick Labyorteaux Net Worth

Understanding an individual's net worth involves exploring various factors influencing financial standing. This analysis considers key aspects that shape financial position.

- Assets

- Liabilities

- Income sources

- Investment strategies

- Career trajectory

- Lifestyle choices

- Economic conditions

- Public perception

An individual's net worth is a complex figure. Assets, like real estate and investments, contribute positively. Liabilities, such as loans and debts, have a negative impact. Income sources, whether from salary or investments, are crucial. Successful career trajectories often correlate with higher net worths. Lifestyle choices and economic conditions also influence the financial outcome. Public perception, while not a direct factor, can shape the narrative. Determining Patrick Labyorteaux's net worth requires meticulous analysis of these factors, illustrating that wealth accumulation is influenced by a combination of career choices, financial decisions, and economic conditions of the time. For instance, a robust investment strategy and stable income stream are indicators of a potentially substantial net worth. Conversely, significant debts or a high-maintenance lifestyle could diminish it.

1. Assets

Assets form a crucial component of an individual's net worth. They represent possessions with monetary value, directly contributing to the overall financial standing. For Patrick Labyorteaux, as with any individual, assets could include tangible items like real estate, vehicles, and collectibles, along with intangible assets like intellectual property or investment holdings. The value of these assets is often market-dependent, fluctuating based on factors such as demand, supply, and economic conditions. A substantial increase in the value of assets will positively influence the net worth.

The types and values of assets held significantly impact an individual's net worth. Real estate holdings, for instance, can represent a substantial portion of wealth. A portfolio of well-performing stocks and bonds demonstrates investment acumen. Other valuable assets, such as artwork or rare objects, can contribute a significant sum. Their valuation may necessitate expert appraisals, adding complexity to calculating net worth. Therefore, the accurate assessment of assets is vital in determining the complete picture of an individual's financial position. The acquisition and management of these assets directly correlate with wealth accumulation and the overall health of an individual's financial standing.

In conclusion, assets are fundamental to understanding net worth. The diversity and value of assets held by an individual, like Patrick Labyorteaux, reflect a complex interplay of financial decisions, investment strategies, and market forces. Accurate evaluation and diversification of assets are critical factors in building and maintaining a favorable financial standing.

2. Liabilities

Liabilities represent financial obligations owed by an individual. In the context of determining an individual's net worth, liabilities act as a subtrahend, reducing the overall value. Understanding the nature and extent of liabilities is crucial for a complete picture of financial standing. This exploration examines key components of liabilities, highlighting their influence on net worth.

- Debt Obligations

This encompasses various forms of debt, including loans (mortgages, auto loans, personal loans), credit card balances, and outstanding invoices. High levels of debt directly reduce net worth. For example, significant outstanding mortgage payments or high credit card balances can significantly decrease a person's net worth. The repayment schedule and interest rates on these obligations influence their impact.

- Unfulfilled Financial Commitments

Unpaid taxes, outstanding legal judgments, and other unfulfilled financial commitments also represent liabilities. Delays or failures in meeting these obligations reduce net worth. These items may not be immediately apparent and require careful examination for a complete picture.

- Future Obligations

Future liabilities, such as potential legal claims or warranty obligations, can also impact an individual's net worth, albeit indirectly. The estimation of such liabilities and their potential impact requires careful evaluation, particularly for individuals with considerable assets or complex financial situations. Professional financial assessments are often utilized in such cases.

- Impact on Net Worth Calculation

Liabilities are subtracted from an individual's assets to calculate net worth. The larger the amount of liabilities, the lower the net worth. The proportion of liabilities relative to assets is a key indicator of financial health. A substantial liability burden can signal potential financial risks. It underscores the importance of responsible borrowing and debt management.

In summary, liabilities are a critical component of calculating and understanding net worth. Accurate identification and assessment of all outstanding financial obligations are essential to a complete evaluation of an individual's financial position. Proper management and responsible financial choices are instrumental in reducing the impact of liabilities on the net worth calculation, ensuring a clearer and more comprehensive financial outlook.

3. Income Sources

Income sources directly influence an individual's net worth. The nature and amount of income significantly affect the accumulation of assets and the management of liabilities. A consistent and substantial income stream allows for savings, investments, and debt repayment, thereby fostering growth in net worth. Conversely, insufficient income can limit savings, restrict investment opportunities, and potentially lead to increased debt, ultimately impacting net worth negatively.

The specific sources of income are crucial. For example, a high-paying job, coupled with substantial investment returns, creates a stronger foundation for a higher net worth. Conversely, a lower-paying job, compounded by significant debt obligations, presents a challenging path to substantial net worth growth. Furthermore, diversified income streams, including investment income, rental income, or royalties, can contribute significantly to overall financial health and net worth. This diversification enhances resilience to economic downturns or changes in market conditions.

Understanding the connection between income sources and net worth is vital for individuals, businesses, and investors. Careful consideration of income streams, both current and potential, is critical in financial planning. This understanding empowers informed decisions regarding financial investments, debt management, and overall financial strategy, contributing to a robust understanding of the key role income plays in wealth creation. Foreseeing potential income fluctuations and planning accordingly are critical steps in optimizing financial stability and net worth growth, regardless of the individual in question.

4. Investment Strategies

Investment strategies play a critical role in shaping an individual's net worth. The choices made regarding investments directly impact the accumulation or erosion of wealth. Effective strategies, aligned with financial goals and risk tolerance, contribute positively to a growing net worth. Conversely, poorly conceived or executed investment strategies can lead to financial losses, potentially diminishing net worth. The success of investment strategies is contingent upon factors such as market conditions, economic trends, and individual financial goals.

The correlation between investment strategies and net worth is multifaceted. Successful investment strategies often involve diversification across various asset classes, including stocks, bonds, real estate, and potentially alternative investments. This approach mitigates risk by spreading investments across different markets, lessening the impact of potential downturns in any single sector. Strategies that align with long-term financial goals, such as retirement planning, tend to produce better long-term results. Furthermore, diligent research and due diligence before making significant investments is essential. Thorough understanding of market dynamics and financial instruments enhances the likelihood of favorable returns and ultimately contributes to a growing net worth. For example, a well-diversified portfolio positioned to take advantage of long-term market trends will likely exhibit superior performance compared to a concentrated investment in a single, volatile asset.

In conclusion, investment strategies are integral to building and maintaining a robust net worth. Effective strategies, aligned with individual financial objectives and risk tolerances, promote wealth accumulation. Conversely, inadequate strategies can diminish net worth. The importance of diligent research, diversification, and a long-term perspective cannot be overstated in achieving desired financial outcomes. This understanding underscores the crucial link between investment decisions and financial well-being. By strategically approaching investments, individuals can maximize the potential for a growing net worth.

5. Career Trajectory

A person's career path significantly influences their net worth. The type of work, length of career, and earning potential directly correlate with accumulated wealth. This exploration examines how career trajectory shapes financial standing, focusing on factors relevant to Patrick Labyorteaux's situation.

- Earning Potential and Compensation Structure

The type of employment and position directly impact income. High-demand professions often correlate with higher salaries. Furthermore, compensation structures, including bonuses, stock options, and profit-sharing, influence overall earnings. Specific career choices within a profession also significantly impact compensation. For example, a senior executive in a lucrative industry generally earns substantially more than a junior-level employee in the same field. The consistent accumulation of higher salaries over a longer career period can create a substantial financial base, allowing for investment and growth in net worth. The compensation structure can also include benefits like healthcare, retirement plans, and other perks, influencing overall financial well-being.

- Career Duration and Stability

The length of a career and its stability affect net worth. A lengthy and stable career allows for consistent income generation and savings accumulation. Opportunities for promotions, advancements, and increased responsibilities over time contribute to greater earning potential and the build-up of assets. Conversely, interruptions, career changes, or instability can negatively impact income and savings. The consistent and reliable stream of income allows for financial planning and investment, a key factor in building substantial net worth.

- Industry and Economic Factors

The industry in which a person works plays a substantial role. Industries with high demand and consistent growth often offer higher compensation and more lucrative opportunities for wealth building. Economic conditions also impact earnings potential. Economic downturns or recessions may impact industry-specific pay and career opportunities. For example, a person's career in a technology sector during periods of growth could see larger salary increases compared to a career in a declining manufacturing industry. The impact of market trends and industry volatility needs to be considered alongside career progression.

- Skills and Specialization

Specialized skills and expertise can significantly increase earning potential. Highly sought-after skills often command higher compensation. The ability to adapt to industry changes and acquire in-demand skills are essential for long-term career success and potentially higher net worth. For instance, a specialized skill in a high-growth technological field can create more opportunities for higher compensation.

Ultimately, a successful career trajectory, encompassing factors like earning potential, career longevity, industry conditions, and specialized skills, contributes significantly to net worth accumulation. These elements highlight how crucial a well-planned and enduring career path is for achieving financial security and success, particularly for an individual like Patrick Labyorteaux, whose career spanned various industries and roles.

6. Lifestyle Choices

Lifestyle choices significantly impact an individual's net worth. Expenses directly associated with lifestyle choices, such as housing, transportation, entertainment, and personal expenditures, directly affect the amount of disposable income available for savings, investments, and debt reduction. A frugal lifestyle, characterized by minimized spending and prioritized savings, often facilitates the accumulation of wealth. Conversely, a lavish lifestyle, marked by high expenditures, can diminish financial resources and hinder wealth growth. Choices in housing, for example, a large, expensive home versus a more modest dwelling, represent substantial financial differences. The lifestyle choices made impact the available funds, directly impacting net worth. The accumulation of wealth is not solely dependent on income; the management of expenses is equally crucial.

Factors like discretionary spending patterns, debt management practices, and saving habits strongly influence net worth. For instance, an individual prioritizing luxury travel over retirement savings could experience a lower net worth compared to someone who prioritizes investments and debt reduction. A significant expense like a large home purchase can impact the net worth. Additionally, consistent financial planning, prioritizing needs over wants, and diligently managing debt contribute significantly to building and sustaining net worth. A focus on debt reduction and building assets through wise financial decisions is a strong driver in wealth creation. The interplay of lifestyle choices, financial habits, and market conditions contributes to the overall financial standing of an individual.

In conclusion, lifestyle choices are a crucial component of determining an individual's net worth. Mindful expenditure, responsible debt management, and a focus on savings are crucial factors. The ability to discern between needs and wants and make conscious financial decisions directly impacts the trajectory of net worth. A detailed understanding of these elements is vital for those aiming to improve or maintain their financial well-being. Careful planning and consistent financial discipline are key for achieving long-term financial goals.

7. Economic Conditions

Economic conditions exert a significant influence on an individual's net worth. Economic fluctuations, including recessions, periods of high inflation, or sustained economic growth, directly affect asset values, investment returns, and income levels. These factors, in turn, impact the overall financial position of an individual, such as Patrick Labyorteaux. For instance, during a period of economic expansion, asset values, such as real estate and stocks, often increase, potentially boosting net worth. Conversely, recessions can lead to job losses and reduced investment returns, thereby decreasing net worth.

The impact of economic conditions extends beyond the fluctuating values of assets. Inflation, for example, erodes the purchasing power of savings, reducing the real value of investments. This means that even if the nominal value of investments remains the same, their practical worth decreases due to the rising cost of goods and services. Changes in interest rates also influence borrowing costs and investment returns, further affecting an individual's financial standing. During periods of high interest rates, borrowing becomes more expensive, potentially hindering investment and impacting net worth. Conversely, low interest rates can encourage borrowing and investment, potentially fostering growth in net worth. Furthermore, industry-specific economic conditions also play a significant role. For instance, a downturn in a particular industry could affect the earnings and job security of an individual working in that sector, thus affecting their net worth.

Understanding the interplay between economic conditions and net worth is crucial for individuals and investors. This awareness allows for proactive strategies to mitigate the negative effects of economic downturns, such as diversifying investments, saving aggressively during periods of economic prosperity, and carefully managing debt. A comprehensive understanding of economic principles is essential to successfully navigate the often unpredictable economic landscape, enabling better financial planning and strategic decision-making for individuals seeking to maximize their financial outcomes.

8. Public Perception

Public perception, while not a direct determinant of net worth, can exert a significant influence on an individual's financial standing. Positive public image can enhance brand value, influence investment decisions, and even affect salary negotiations. Conversely, negative perceptions can damage reputation, impacting career opportunities and potentially decreasing earning potential. A robust public image may generate additional income streams, such as endorsement deals or opportunities for media appearances, contributing to wealth generation. However, the association between public perception and net worth is not a simple cause-and-effect relationship; numerous mediating factors often intervene.

Consider celebrities, for instance. A favorable public image can lead to higher demand for their services, including endorsements, product placements, and speaking engagements. This translates to increased income streams, contributing significantly to their overall net worth. Conversely, negative public relations, such as controversies or scandals, can harm their reputation, leading to the loss of endorsements, decreased demand for their services, and potentially diminishing their net worth. The impact of public opinion on stock prices of companies associated with public figures further demonstrates the link between image and investment. Favorable public sentiment can lead to increased stock prices, and conversely, negative news can negatively impact the value of associated assets.

Understanding the link between public perception and net worth is crucial for individuals in public life or those seeking to build a brand. Maintaining a positive image through ethical conduct, strong communication, and strategic engagement with the public can maximize opportunities for financial success. Careful management of public image, particularly in light of potential controversies or negative events, is vital for mitigating potential damage to one's financial standing. Public perception, therefore, is not a direct cause of net worth, but it can be a powerful contributing factor by influencing opportunities and perceptions of value, affecting the perceived worth of both individuals and assets.

Frequently Asked Questions about Patrick Labyorteaux's Net Worth

This section addresses common inquiries regarding Patrick Labyorteaux's financial standing. Information presented here is based on available public data and general knowledge of wealth accumulation.

Question 1: What is Patrick Labyorteaux's net worth?

Precise figures for Patrick Labyorteaux's net worth are not publicly available. Estimating an individual's financial standing requires detailed analysis of assets, liabilities, and income sourcesdata typically not released publicly for private individuals.

Question 2: How is net worth determined?

Net worth is calculated by subtracting total liabilities (debts) from the total value of assets. This process requires valuations of various holdings like real estate, investments, and personal belongings, along with accounting for any existing debts.

Question 3: What factors influence an actor's net worth?

Several factors contribute to an actor's net worth, including salary, film and television roles, endorsements, investments, and overall career trajectory. Furthermore, economic conditions and individual spending habits influence the accumulation or erosion of wealth.

Question 4: Is public information about net worth reliable?

Publicly available information regarding celebrity net worth estimates often comes from various sources, each with varying degrees of accuracy. Direct confirmation of these figures typically is not possible.

Question 5: How does a career in acting impact net worth?

A successful acting career can lead to substantial income, contributing to a higher net worth. Earnings depend on factors like roles' compensation, popularity, and the actor's ability to secure profitable ventures beyond acting. Career longevity and the ability to create consistent income streams are vital.

In summary, precise figures for Patrick Labyorteaux's net worth are unavailable due to privacy considerations. Estimating net worth requires detailed, often inaccessible, data about assets, liabilities, and income streams. Publicly available information is generally an estimate, not a definitive figure.

This concludes the Frequently Asked Questions section. Further exploration into the specifics of Patrick Labyorteaux's career and investments is not possible with publicly available information. The next section will explore related topics in more detail.

Conclusion

Determining Patrick Labyorteaux's net worth proves challenging due to the absence of publicly accessible financial records. While various factors, including career earnings, investment strategies, and lifestyle choices, influence an individual's financial standing, a precise figure remains elusive. This article explored the intricate interplay of assets, liabilities, income sources, investment strategies, career trajectory, lifestyle choices, economic conditions, and even public perception in shaping an individual's financial situation. However, without detailed financial disclosures, accurate estimations are impossible. The discussion highlights the complexity of financial information and the limitations of public access to such data.

The exploration of these factors underlines the importance of responsible financial management for anyone. Understanding the multifaceted influences on net worthfrom professional success to individual spending habitsprovides valuable insights for developing sound financial strategies. Furthermore, the limitations encountered in accessing private financial information underscore the significance of transparency and financial literacy in today's economic landscape. Ultimately, this inquiry serves as a reminder that financial standing is a complex and often private matter.

- Is Moon Ga Young Dating Someone Relationship Status Update

- Carlos Vela Top Goalscorer And Premier League Star